“There’s multiple way to build wealth,” Rose says. “From an training standpoint, these are conversations you should have as it’s not merely the asset that you want to pass on. It’s also the data.”

The most effective alternative investments supply much-wanted diversification with your portfolio, and as they typically don’t behave like shares and bonds, they can offer protection towards volatility during the stock and bond marketplaces.

You don’t need to be a wine connoisseur to realize why great wine might be a worthwhile investment.

For all those enthusiastic about Discovering more about EquityMultiple, take into consideration signing up for an account and going through their qualification method.

Our enterprise keeps high stability benchmarks and one of our security applications has flagged this request as potentially malicious.

General Motors purchased the corporation in 2016, building income for buyers and offering an air of legitimacy into the crowdfunding industry.

Hedge money typically pool dollars from a bunch of traders, then make investments People money into shares, bonds, and alternative investments to deliver returns. Their aims may well fluctuate—numerous hedge funds basically find out substantial complete returns, but Some others search to provide constant returns by means of all sorts of market environments, even at the price of subpar efficiency through substantial-growth bull markets. Liquidity tends to be relatively substantial, with investors in a position to pull resources in a day or considerably less.

We also reference primary investigation from other reliable publishers where acceptable. You are able to Anderson find out more concerning the requirements we abide by in developing correct, impartial content within our

With out a foundation to stick to, an surprising expenditure or unforeseen decline could need dipping into very long-expression investments to deal with quick-expression demands.

There is no financial institution linked to P2P lending. Your cash is often pooled with other buyers’ revenue, and alongside one another you create a financial loan to the individual asking for funds.

Lending cash often generates the danger that you may not get it back. Peer-to-peer financial loans are unsecured, that means they aren't backed by a tough asset similar to a car or truck or a house, which you could potentially repossess if needed.

☝ This evaluation shouldn't be a foundation for selecting a retirement account: that would choose a great deal more webpage examine. It’s a place to begin that will assist you to get knowledgeable about many of the most popular options

Source: Hartford Money There’s a purpose that “time in the market beats timing the industry” is a popular adage: Reaping the benefits of the market’s prolonged-term returns calls for enduring quick-phrase volatility.

A transparent look at of one's holistic economical situation is the muse of fine final decision-making. I usually do the job with customers to revise their net well worth and the list in their assets and liabilities to replicate any adjustments through the preceding 12 months.

Edward Furlong Then & Now!

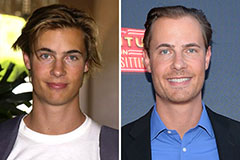

Edward Furlong Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Batista Then & Now!

Batista Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!